New Strategic Growth Framework

TOTAL ANNUAL GROWTH THROUGH THE CYCLE

LONG-TERM

FINANCIAL FRAMEWORK

- 35% core earnings conversion

- EPS growth > sales growth

- FCF conversion ~100%

- ROIC > 20%

- Target 2x leverage

Margin Expansion

| Margin Growth Drivers | Long-term Range* | |

|---|---|---|

| Intelligent Devices |

|

22% - 24% |

| Software & Control |

|

31% - 34% |

| Lifecycle Services |

|

13% - 15% |

| Total ROK | Productivity | Supply chain improvement | Accelerated top line growth |

|---|

*Excludes impact of future acquisitions

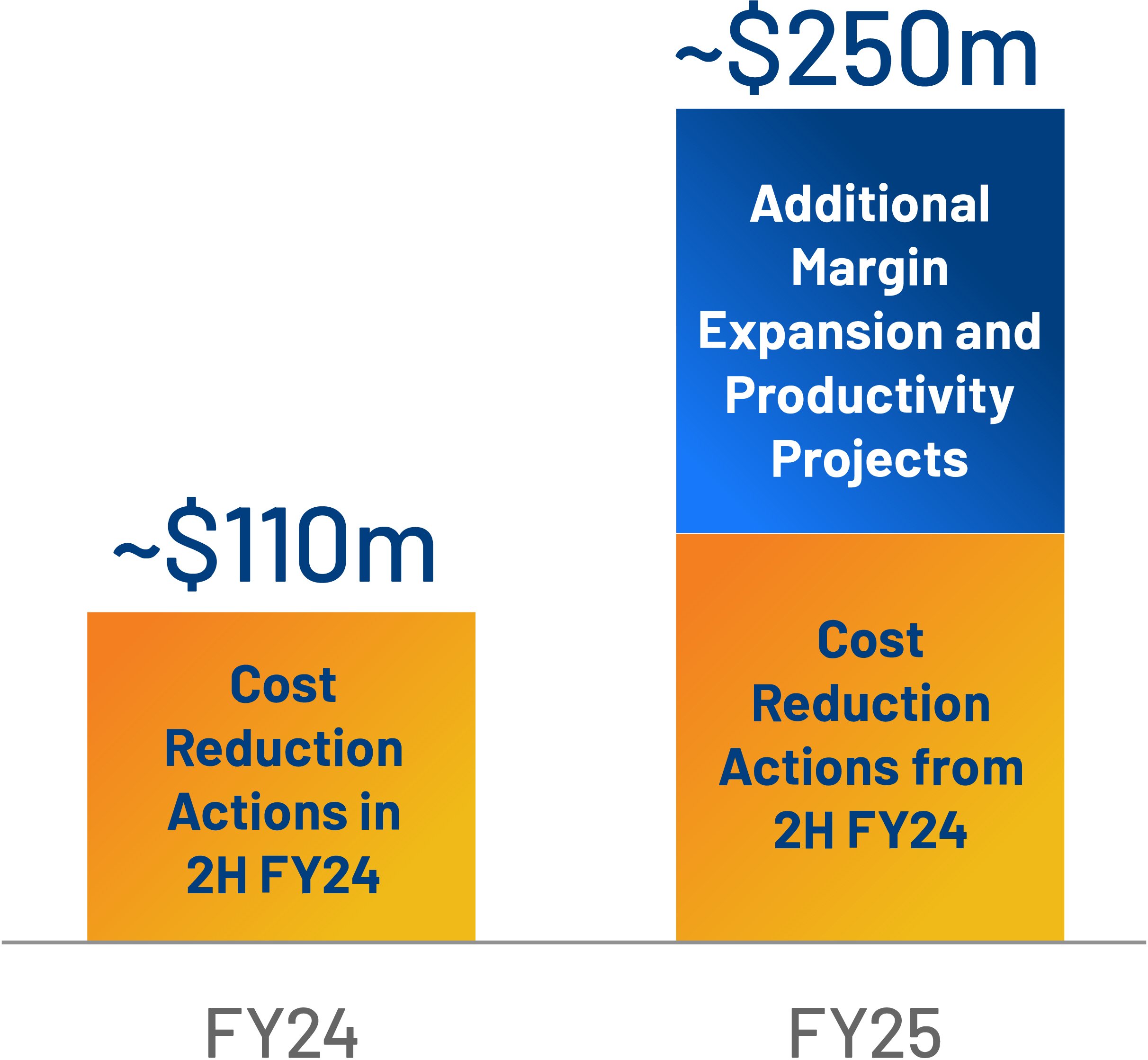

Margin Expansion and Productivity

ROK Operating Model to drive margin expansion and productivity through FY25 and beyond

| Enterprise Scale and Efficiency | SG&A Cost Reduction |

|

| Process Efficiency | Leverage technology to redesign processes and reduce manual work | |

| Product Cost Reductions | Direct Material Sourcing | Supplier consolidation and negotiation |

| Product Redesign | Design changes to improve cost and manufacturability | |

| Indirect and Supply Chain Optimization | Indirect Sourcing | Supplier negotiation and optimization of IT & outside engineering spend |

| Logistics | Shift from air to ocean where applicable; logistic supplier negotiation | |

| Manufacturing Efficiency | Process improvement to increase yield and reduce manufacturing costs | |

| Real Estate Footprint | Space optimization and elimination of low utilization facilities | |

| Portfolio Optimization | SKU Rationalization | Reduction of low volume/low margin SKUs |

| Price Optimization | Increase price on low volume SKUs |

| Enterprise Scale and Efficiency | |

|---|---|

| SG&A Cost Reduction |

|

| Process Efficiency | Leverage technology to redesign processes and reduce manual work |

| Product Cost Reductions | |

| Direct Material Sourcing | Supplier consolidation and negotiation |

| Product Redesign | Design changes to improve cost and manufacturability |

| Indirect and Supply Chain Optimization | |

| Indirect Sourcing | Supplier negotiation and optimization of IT & outside engineering spend |

| Logistics | Shift from air to ocean where applicable; logistic supplier negotiation |

| Manufacturing Efficiency | Process improvement to increase yield and reduce manufacturing costs |

| Real Estate Footprint | Space optimization and elimination of low utilization facilities |

| Portfolio Optimization | |

| SKU Rationalization | Reduction of low volume/low margin SKUs |

| Price Optimization | Increase price on low volume SKUs |

Incremental YOY Benefit

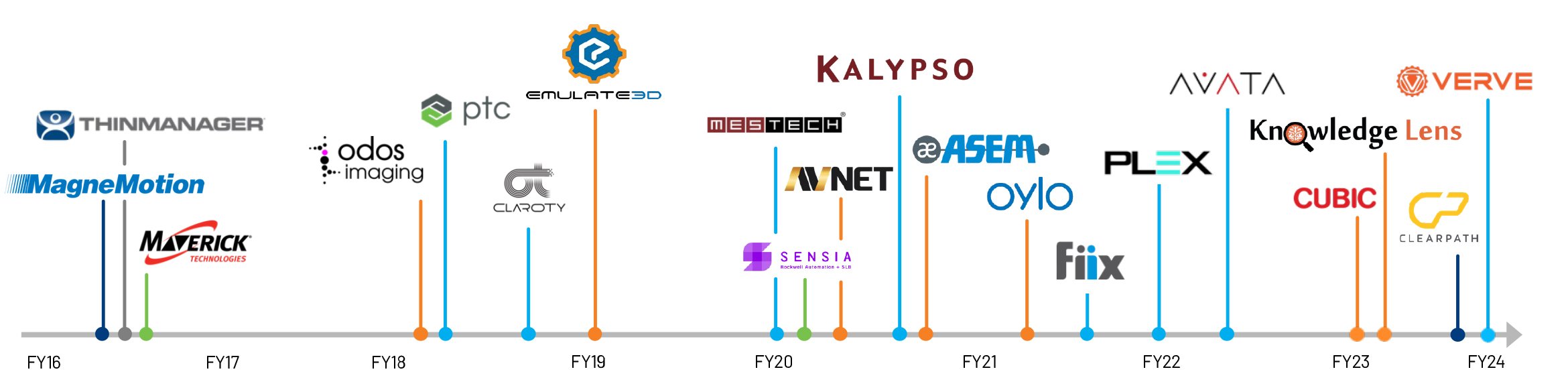

Inorganic Investments

New inorganic

priorities

- Annual Recurring Revenue

- Market Access in Europe / Asia

- Application-specific Technology in Focus Industries

Prior inorganic

priorities

Process Expertise

Information Solutions / Connected Services

Market Access in Europe / Asia

Advanced Material Handling

Capital Deployment

Our strong balance sheet provides us with significant flexibility and capacity to deploy capital. Our capital deployment priorities have not changed: make investments to fund organic growth, drive a point or more per year of growth from strategic acquisitions, and return excess cash to shareowners through dividends and share repurchases.

ORGANIC INVESTMENTS

Operating Cash Flow

Capital Expenditures

~2 to 3% of Sales

Free Cash Flow

~100% of Adjusted Income

INORGANIC INVESTMENTS

Acquisitions

Target ~1 pt of growth per year

EXCESS CASH RETURNED TO SHAREOWNERS

Dividends

Maintain “A” credit rating

Share Repurchases

Framework for Continued Superior Financial Returns

Our longer-term framework for financial performance starts with organic sales growth, which drives earnings conversion (incremental margins). Free cash flow conversion of 100% or more and a strong balance sheet provide significant capacity for strategic capital deployment, including acquisitions and share repurchases. As a result, we expect EPS growth to outpace revenue growth and ROIC to remain over 20%.